Understanding Crash Point Games

This article addresses that intent directly. It explains what a crash point game is, how its mechanics work, and what risks are involved. The goal is understanding, not encouragement.

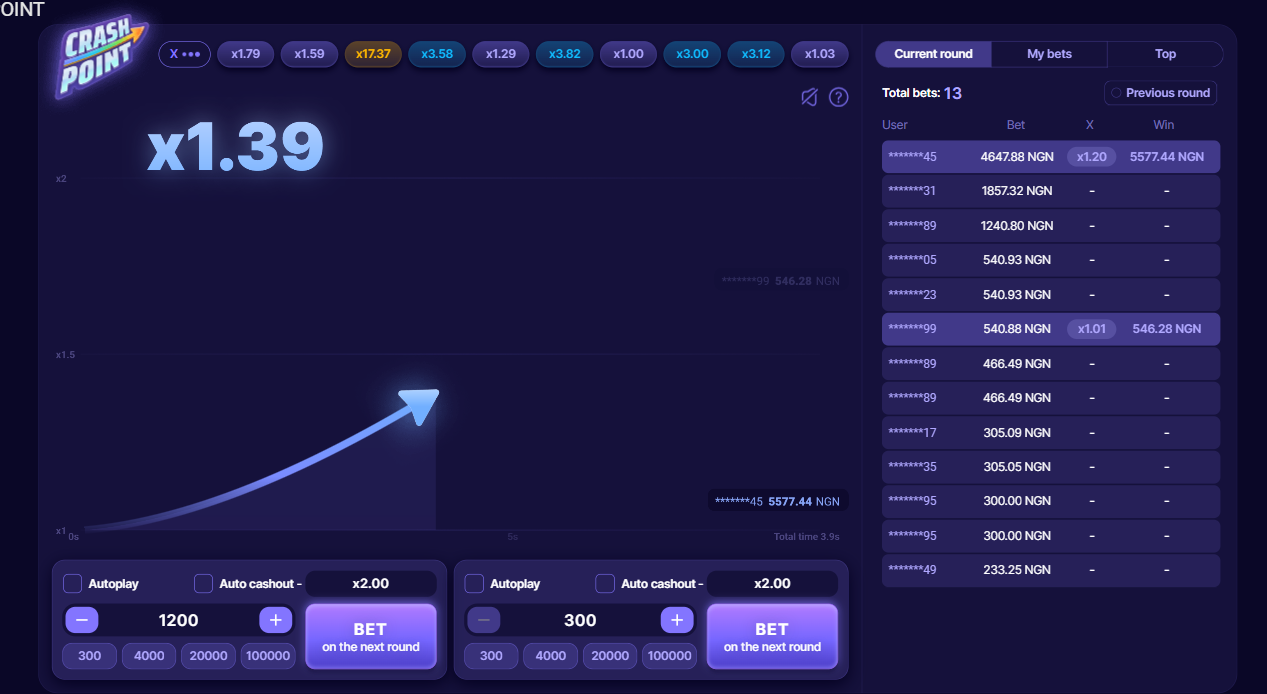

At its core, a crash point game is a probability-driven wagering format. A multiplier rises in real time. At an unknown moment, it stops. The round ends at that stopping value, known as the crash point. Participants decide when to exit before the crash occurs. If the exit happens earlier, the return is calculated using the multiplier at that moment. If the crash happens first, the wager is lost.

That simple structure explains why these games attract attention. It also explains why they carry high volatility. Outcomes are not predictable, and past rounds do not determine future ones.

How the Crash Point Mechanic Works

Each round begins at a base multiplier, usually 1.00x. The multiplier increases continuously over time. The system determines a crash point in advance using a random process. Players do not see this value.

The key decision is timing. Exiting earlier results in a smaller multiplier. Waiting longer increases potential payout but also increases the chance of losing the entire stake. There is no skill-based method to identify the exact crash moment. Decisions are made under uncertainty.

From an educational standpoint, this structure mirrors classic risk-reward trade-offs. Lower risk is associated with earlier exits. Higher risk comes with delayed exits. Neither option removes uncertainty.

Probability and Randomness

Crash point games rely on random number generation. Each round is independent. The outcome of one round has no mathematical effect on the next.

This independence is critical to understand. Patterns perceived by observers are usually random variation rather than signals. Short streaks of low or high crash points can occur naturally without implying a trend.

Some platforms describe these games as “provably fair.” This term usually means that cryptographic methods allow verification of outcomes after the round. It does not mean that the game favors the user or reduces risk. It only addresses transparency in outcome generation.

Multipliers and Expected Value

The multiplier represents a potential return, not a guaranteed one. As the multiplier increases, the probability of the round ending also increases. These two forces balance each other in a way that favors the house over time.

Expected value is a useful concept here. It refers to the average result over many rounds. In crash point games, expected value is typically negative for participants due to built-in margins. This does not mean every round ends in a loss. It means that long-term results trend downward when played repeatedly.

Understanding expected value helps frame the activity correctly. Short-term outcomes can vary widely. Long-term outcomes are shaped by probability and structure.

Timing Decisions and Cognitive Bias

Crash point games highlight several common decision-making biases. One is loss aversion. Players may hesitate to exit early because the multiplier still appears to be rising. Another is the gambler’s fallacy, where recent outcomes are mistakenly believed to influence future ones.

There is also the illusion of control. The act of choosing when to exit can feel strategic. In reality, the crash point is already determined. The choice only affects exposure to risk, not the underlying odds.

Recognizing these biases is part of responsible engagement. Awareness does not eliminate risk, but it improves decision clarity.

Comparing Crash Point to Traditional Betting Formats

Crash point games differ from fixed-odds betting and casino table games. There is no predefined wager outcome such as win or lose on a specific event. Instead, outcomes exist on a continuous scale.

The following table clarifies this distinction.

| Feature | Crash Point Games | Fixed-Odds Sports Bets |

| Outcome type | Continuous multiplier | Binary or limited outcomes |

| Timing element | Real-time exit decision | Pre-event commitment |

| Probability visibility | Implicit | Explicit odds |

| Volatility | High | Varies by market |

This comparison highlights why crash point games feel different. The lack of visible odds does not remove probability. It simply hides it within the multiplier curve.

Risk Exposure and Bankroll Considerations

Because outcomes can resolve quickly, crash point games can lead to rapid changes in balance. This speed increases risk exposure. It also increases the importance of limits.

Responsible frameworks treat betting as entertainment with a predefined cost. That cost should be affordable and separate from essential finances. Time limits matter as much as financial ones, especially in fast-paced formats.

No system or timing approach can eliminate risk. Adjusting behavior only changes how that risk is experienced.

Educational Value and Responsible Context

From an educational perspective, crash point games are useful examples of probability under uncertainty. They illustrate how randomness, expected value, and human behavior interact.

They are not investment tools. They do not offer predictable returns. Viewing them through a learning lens rather than a profit lens aligns with responsible gambling principles.

Many platforms include tools such as self-exclusion, deposit limits, and session reminders. These tools support informed decision-making. Using them is consistent with treating betting as entertainment rather than income.

Final Perspective

Crash point games, including those accessed through links like https://1xbet.ng/en/games/crash-point, operate on simple mechanics with complex implications. A rising multiplier and an unknown endpoint create tension and volatility. Probability governs every round. Control is limited to exposure, not outcome.

Understanding these mechanics helps readers approach the format with clarity. It frames expectations realistically. It also reinforces the central principle of responsible gambling. Uncertainty is inherent, risk is unavoidable, and informed restraint matters more than prediction.